What is Diversification?

Diversification is the process of spreading out one’s investments across different asset classes, industries, sectors and market places so as to reduce the overall risk of the portfolio.

Diversification attempts to protect against losses. This is especially important for older investors who need to preserve wealth toward the end of their professional careers. It is also important for retirees or individuals approaching retirement that may no longer have stable income; if they are relying on their portfolio to cover living expenses, it is crucial to consider risk over returns.

As the famous saying goes, ‘Don’t put all your eggs in one basket’. The idea is that when we hold different assets, the poor performance of one or two asset classes will not significantly impact one’s portfolio and will be offset by the better performance of the other asset classes in the portfolio, as opposed to if we invested all our money into only one asset class or stock.

Example

Let’s say you have invested your savings in only airline stocks and they crash because of an industry specific news such as a pilots strike that would cause a cancellation in many flights. Now your entire portfolio would take a big hit due to this event. You can counter this risk by investing part of your money in railway stocks because people would use railway as a mode of transport and there is a good chance that their stocks would go up. This way only a part of your portfolio is affected and the other part is making profits thereby reducing the risk of your overall portfolio.

The example of investing in railway stocks to counter the risk in airline stocks is a way of diversifying within an industry. In such cases, the investor has put all his money into the transport sector and could lose a significant part of his/her portfolio if there is news that could negatively affect the entire transport sector. If that were to happen, people would not travel much and choose to sit at home. This act would cause media/streaming company stocks to go up. Hence people should consider diversifying outside the industry as well.

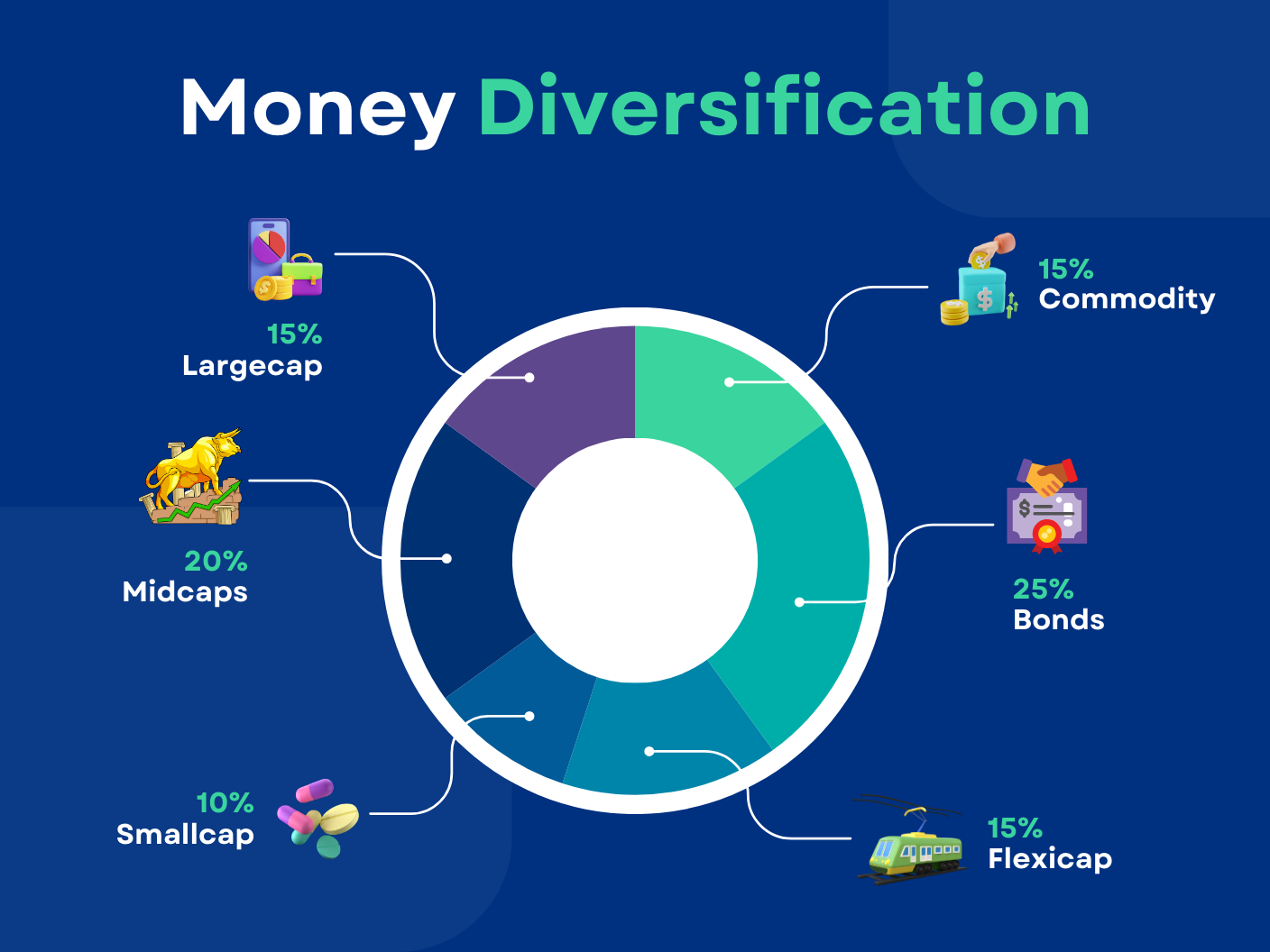

We have spoken about diversifying in sectors in the above examples. There could be a scenario where the equity markets go through a bear run or crash which causes a downfall in the market of about 15-20%. In such cases, diversification into sectors would not help much. The idea here would be to invest in different asset classes that will not fall when the equity markets fall. Investing in bonds, real estate, crypto currencies, private equity would help further reduce the downside risk.

How many needed to diversify?

There is no magic number of stocks that are needed to be held in order for diversification to do its work. According to modern portfolio theory, an investor can achieve optimal diversification with around 20-30 stocks spread around different sectors.

For investors who cannot afford to invest in as many as 30 stocks, they can invest in mutual funds. By buying mutual funds, the investor gains ownership of multiple companies that the fund has invested in and reaps the benefits of diversification as well.

How can we help you diversify?

As you embark on your journey towards a well-diversified investment portfolio, Plan4Sure stands ready to be your trusted partner in achieving financial success. Our suite of financial products, including mutual funds, insurance, tax planning services for optimal exemptions, private equity, alternate investment funds, and bonds, provides you with a diverse array of options.

Let us be your trusted companion in transforming these principles into a personalized investment plan that aligns with your financial goals. Start your journey toward a diversified and resilient investment portfolio by connecting with us today.